There has been very little normalcy in calendar year 2020. We as a country, our communities, and each of us individually have taken on challenges over the last 10 months that we couldn’t have imagined prior to this year. “We’re in this together” has been a message of hope and support as each of us looks to “hang in there” this year. From the COVID-19 health pandemic, to civil unrest, to the upcoming national elections, there is much that raises concern and, in some cases, fear. Yet, as these challenges have mounted over the last few months, our organization is resolved to continuing some of our traditions that have created a positive and lasting impact on both our team and others. It is a small decision that we, as an organization, hope to foster with yours. Let me explain.

Blue Rose traditionally holds an annual meeting at our Minneapolis headquarters every fall. All members of the Blue Rose team and sister organizations gather in September or October for various business and social activities. A now retired former colleague of mine used to call these types of meetings a “group hug,” perhaps in recognition of the corporate style approach that he long ago experienced at larger organizations throughout his career. Despite the humor in this description, for us, our desire is much greater than the brainstorming, camaraderie, side-by-side work, and yes, even compliance training, that we get to do by coming together each fall. Like in our day-to-day work for clients, we desire to serve and make an impact for others. Through our service, we believe our actions can have a positive impact on people, our communities, and our country.

This year, as one might expect, we were unable to bring our team together in person. The health and safety of our team is paramount. For this reason, we elected to avoid the planes, trains, and automobiles to do our part to reduce the virus spread amongst ourselves and those around us, and to continue to “flatten the curve” for the benefit of those who contract COVID-19 and our health care systems. This is a commitment we’ve made since March and will continue as long as necessary. Yet, we couldn’t let the opportunity to serve others pass us by this year. At prior annual meetings, our team has worked together on service projects at locations such as local youth shelters and work training organizations, non-profit food shelves and international food distributors, and, last year, the Ronald McDonald House. Were we supposed to let this annual tradition go by just because it’s 2020?

Instead, since we couldn’t be together, our organization allowed each team member to select a charity of their choice which both they and the company would financially support. On the surface, one could look at it as simply a matching contribution program offered by the company. But in reality, the impact was much greater than the dollars that were committed to the various organizations. As each colleague of mine had the chance to present the charity of their choice and the reason for choosing it, the passion our team has for myriad of social and just causes could not have been more evident. Yes, some fittingly selected the local food shelters and youth programs to support once again. But to hear the messages of hope in the midst of crisis being brought forward by national suicide prevention and mental illness organizations, international clean water initiatives, and justice for incorrectly incarcerated (mostly African-American) individuals were just some of the causes that our team elected to shine a light on this year. For many of us lately, our day-to-day world can often feel rather small. But with so much need in this world, as evidenced again for us during our annual meeting, a commitment to service and outreach is one that we cannot forget. Not in a time like this. Not in 2020.

As the holiday season begins to come upon us this year, I suspect your company and/or family traditions may change, or you may even consider taking a year off. But, like our team at Blue Rose, I encourage you to think creatively about how we can make a favorable impact on people and organizations in need. We can all play a part in not just getting through this year but making a difference to those both around us and around the world. I encourage you, your families, and your organizations not just to survive but to find ways to help others thrive in the world we live in today. The traditions may change, but with a little creativity, the impact can continue.

Last year’s article: 2019

About the Author:

Erik Kelly serves as President of Blue Rose, providing leadership, coordination, and oversight of the firm’s advisory services since 2011. He also serves as the lead advisor to many of the firm’s clients, including advising higher education, non-profit, and other borrowing entities on the planning for and execution of all types of debt and debt-related derivative transactions. In managing the firm’s various advisory service areas, Mr. Kelly oversees both compliance with the changing regulatory environment and the delivery of professional advice to the firm’s clients.

Mr. Kelly holds a bachelor’s degree in economics from Amherst College and a master’s degree in theological studies from Bethel University. Mr. Kelly passed the MSRB Series 50 Examination to become a qualified municipal advisor representative and the MSRB Series 54 Examination to become a qualified municipal advisor principal.

Comparable Issues Commentary

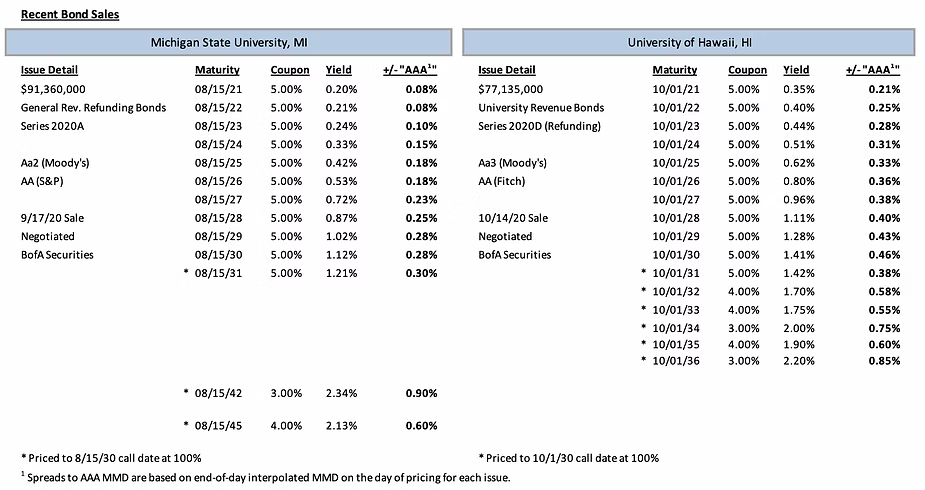

The two universities priced into a fairly stable tax-exempt market, though tax-exempt rates increased slightly over the weeks between MSU and UH’s respective pricings (ranging from ~2 bps increases on shorter tenors to up to 15 bps increases further down the yield curve). The market was quite stable on the pricing dates for both institutions, with MMD unchanged across the curve on both September 17th (MSU) and October 14th (UH). Both schools utilized similar bond structures, each opting for standard 10-year par call options as well as meaningfully similar couponing structures (with 5% coupons on noncallable maturities before primarily shifting to lower 3% or 4% coupons on callable bonds). However, the final maturities did differ between the two transactions, with Hawaii’s 2020D bonds reaching their final maturity in 2036 while Michigan State’s bonds, because of the respective amortization structures of the two refunded bond series, had a gap in maturities (with no principal amortization) between 2032-2040 before the amortization of the 2015A refunding from 2041 through the 2045 final maturity. Spreads on the financings ranged from 8-30 bps for Michigan State on directly comparable maturities from 2021-2031, compared to a range of 21-46 bps for Hawaii over the same maturities.

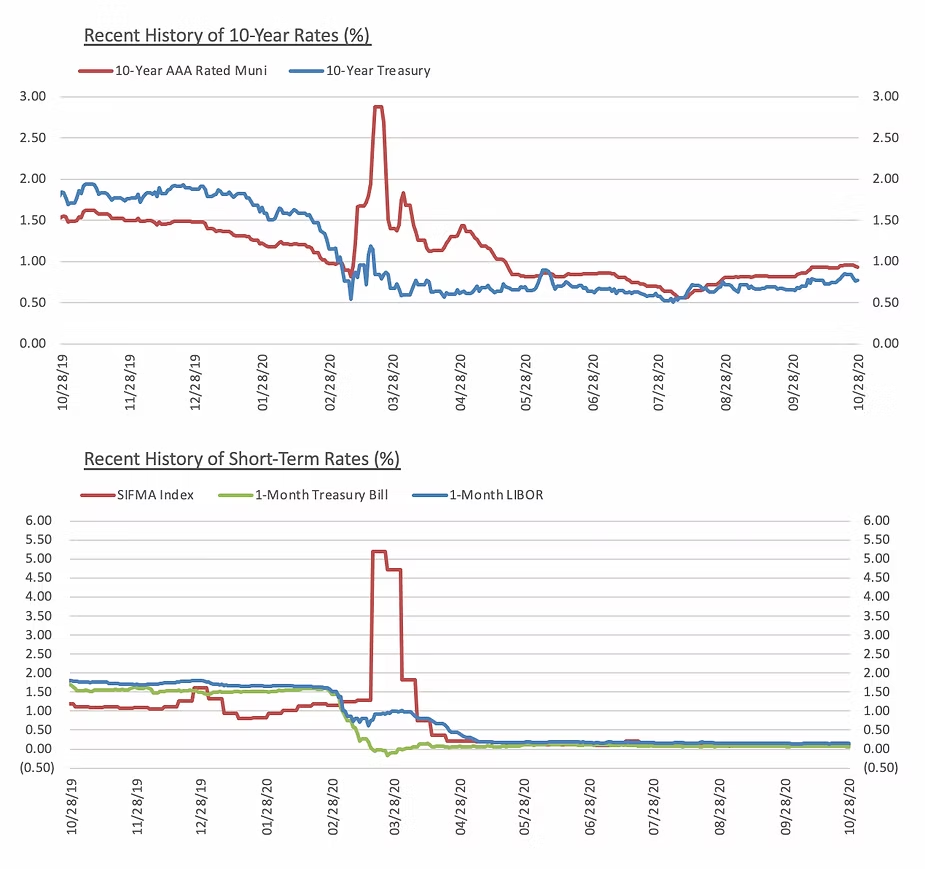

Interest Rates