2021 saw a continued demand for – and high issuance of – municipal bonds following record performance in 2020, though higher education issuance was down compared to the prior year, following a decline in taxable issuances. Both absolute yields and credit spreads retracted in the spring to the lows seen prior to the start of the COVID-19 pandemic. Rates have come off those levels leading into the beginning of the year, though the market remains strong for borrowers. As discussed in our October Shield newsletter [1], college and university endowments saw record investment returns, helping offset some of the negative credit pressure applied by the ongoing COVID-19 pandemic. As we turn our focus to the coming year a few market trends we are focusing on at Blue Rose are:

Inflation

The consumer price index (CPI) rose 7% last year, and economists expect it to grow by a more moderate 3% in 2022. [2] Clearly, a variety of factors will impact this projection, though one of the major drivers is expected to be COVID variants such as Omicron, which have the potential to further disrupt supply chains and spending patterns in 2022. The impacts of high inflation on institutions we serve primarily relate to budgetary pressure, though there is concern that, depending on rate movement, inflation could also have a negative impact on new issuance volume.

Movement of Interest Rates

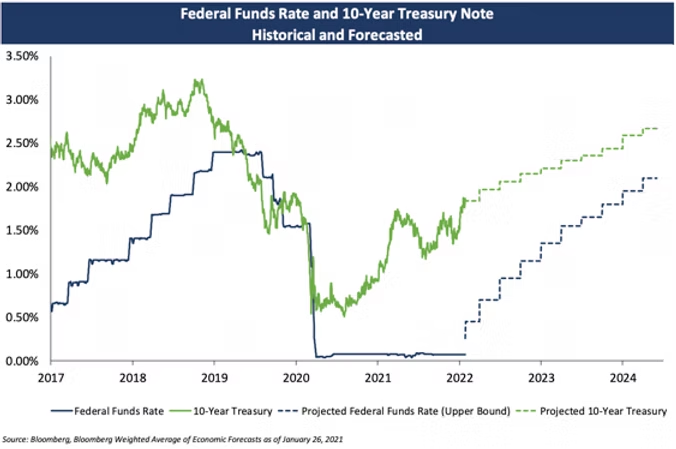

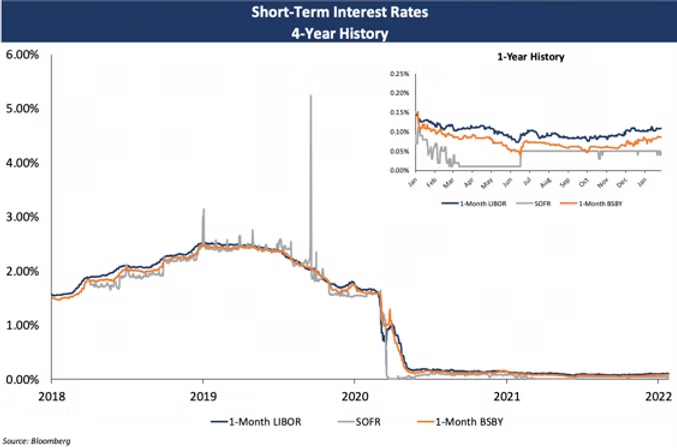

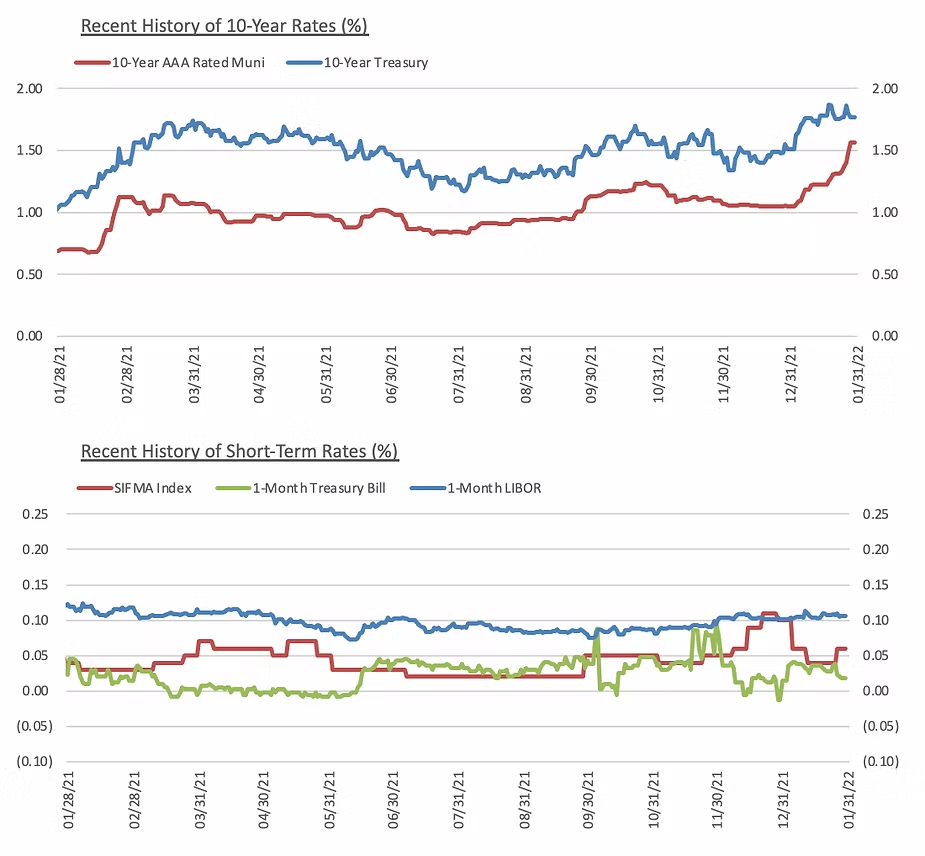

Since the Fed’s overnight target rate fell in response to the COVID-19 pandemic, each market update we’ve written has included an economist forecast graph like the one below, where the consensus forecast for short and long term rates is shown to project a rising rate environment. Like most predictions, these forecasts aren’t 100% accurate, and so far, short-term rates have remained near 0%. However, the Fed has begun to set the stage more definitively for interest rate hikes starting as soon as March as one measure to curb inflation. Conversely, long term rates have increased over the last year and are now nearing pre-pandemic levels, leading some to believe that this interest rate growth may have already been captured by most forecasts. While general market expectations are for some increase in long-term rates, it is not predicted to be as substantial as the projected rise on the shorter end of the yield curve. One major factor that could dampen the pace of interest rate hikes in 2022 would be a continued slide of equity markets, as signs of economic slowdown might cause the Fed to reduce or slow its planned cadence of rate increases.

LIBOR Transition

If you have LIBOR exposure or would like to discuss capital plans in the context of these market conditions, then please reach out to your Blue Rose advisor to schedule some time to chat.

Comparable Issues Commentary

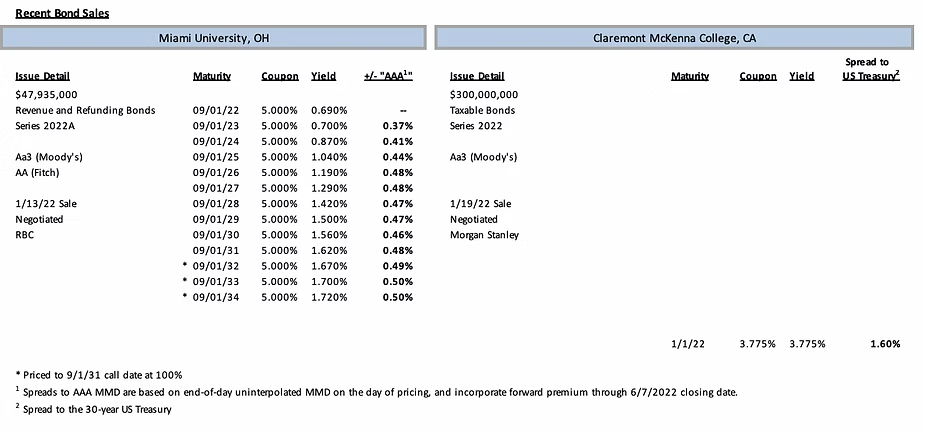

Shown below are the results of two higher education issues which sold in the month of January. Miami University of Ohio priced its tax-exempt bonds on January 13th. The following week on January 19th, Claremont McKenna College priced its taxable century bond. Miami’s Series 2022A bonds were issued to execute a forward current refunding of the university’s outstanding Series 2012 bonds, which become callable on September 1, 2022. Claremont McKenna’s Series 2022 taxable bonds were issued for several purposes, including the advance refunding of $96.3 million of the College’s outstanding Series 2015A bonds, callable on January 1, 2026. Claremont McKenna plans to use the remaining proceeds from its century bond for a variety of capital projects. These projects include the new Robert Day Sciences Center, as well as the development of 75 acres of recently purchased land which will house the College’s east campus sports complex.

Both schools’ bonds were rated “Aa3” by Moody’s, with Miami’s bonds also carrying a AA rating from Fitch. However, the structure and amortization of the transactions varied significantly. Miami’s tax-exempt issue was fully serialized across the scale from 2022-2034 and utilizes a forward delivery structure, with closing not scheduled until June 2022. The University chose to pursue a forward delivery as opposed to waiting to execute a standard current refunding in order to lock in guaranteed savings in a potentially rising interest rate environment. Miami used exclusively 5% coupons on the issue, which carries a 9-year call date, matching that of its Series 2021A bonds issued last summer. In contrast, Claremont McKenna’s issue was a taxable century bond featuring a single bullet maturity in 2122 and carrying an interest rate of 3.775%. This structure will allow Claremont to normalize debt service at approximately $18 million per year until the 2051 bullet maturity of its Series 2019 bonds, after which debt service will decrease to just over $11 million per year. Claremont McKenna’s century bond is also notable in that it is the first deal of its kind to price in the higher education sector since the onset of the COVID-19 pandemic in early 2020. The sizing of the two transactions was also meaningfully different, with Miami’s bonds coming in at just under $48 million compared to a larger $300 million transaction for Claremont McKenna.

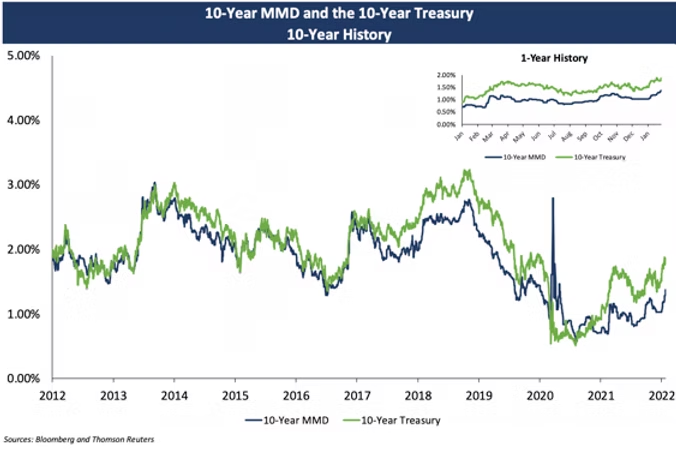

The two transactions each priced into the rising interest rate environment that has been prevalent for the beginning of 2022, with both tax-exempt and taxable rates increasing sharply during the month of January. MMD increased by 13-16 bps in the week prior to Miami’s pricing, but stabilized more during the week of January 10th, increasing another 2-11 bps on the first 9 years of the yield curve, but by just 1 bp on later maturities heading into the January 13th pricing. The market was quite steady on the actual pricing date for the University’s bonds, with MMD on January 13th unchanged through 2031 and reduced by 1 bp on all maturities thereafter. Claremont McKenna priced in similar conditions, with the 30-year treasury rising by over 25 bps over the month of January heading into its pricing. The 30-year treasury rose by 7 bps the day leading up to the College’s bond sale, before falling by 1 bp on the January 19th pricing date. Despite these challenging market conditions Claremont still achieved solid pricing when compared to pre-pandemic century bonds of similar credit quality, with a final credit spread of 160 bps to the 30-year treasury. In comparison, the University of Southern California (rated AA by S&P) priced a century bond in January of 2020 at a spread of 120 bps with a 3.226% rate, and just a few months prior, in November 2019, Cal Tech (rated Aa3/AA- by Moody’s and S&P) achieved a spread of 145 bps with a rate of 3.65%.

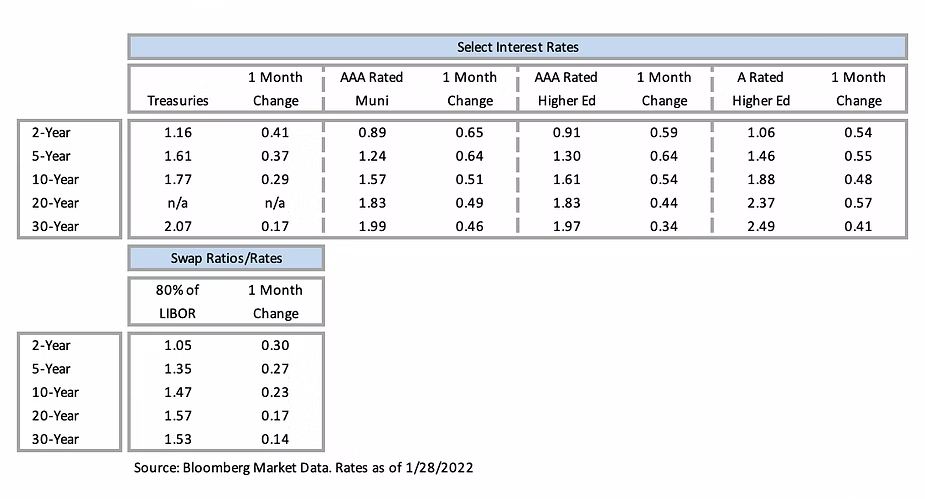

Interest Rates

Meet the Author

Brandon Lippold, Assistant Vice President | [email protected] | 952-746-6054

Brandon Lippold joined Blue Rose in 2018 as a Quantitative Analyst, providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. In the role of Associate, he utilized his experience as a Quantitative Analyst in a more client-facing role, while still performing much of the analysis utilized in this capacity. In his role of Assistant Vice President, he will be tasked with growing client management responsibilities, in particular ensuring that our clients’ transactions run smoothly through closing.

Media Contact: