It is with great joy that our Blue Rose advisory team serves organizations across the country with the goal of improving their financial health.

For example, on June 30, 2023, LIBOR cessation was completed. Variable rate bonds and notes, lines of credit, and derivative products that were once reset off a LIBOR index (including all its permutations) were converted to or assigned a new or different index, often SOFR. Whether fallback protocols were adopted, proactive amendments were made, or refinancing transactions were executed, LIBOR faded into the sunset mid-last year. From the very beginning of the anticipation of LIBOR cessation, our team was attentive to the challenges that LIBOR transition would bring to the market as a whole and to our own clients’ circumstances. We analyzed scenarios, advised on a best approach, and assisted in efficiently executing various LIBOR transition strategies. In the end, our clients overcame the LIBOR challenge that was years in the making.

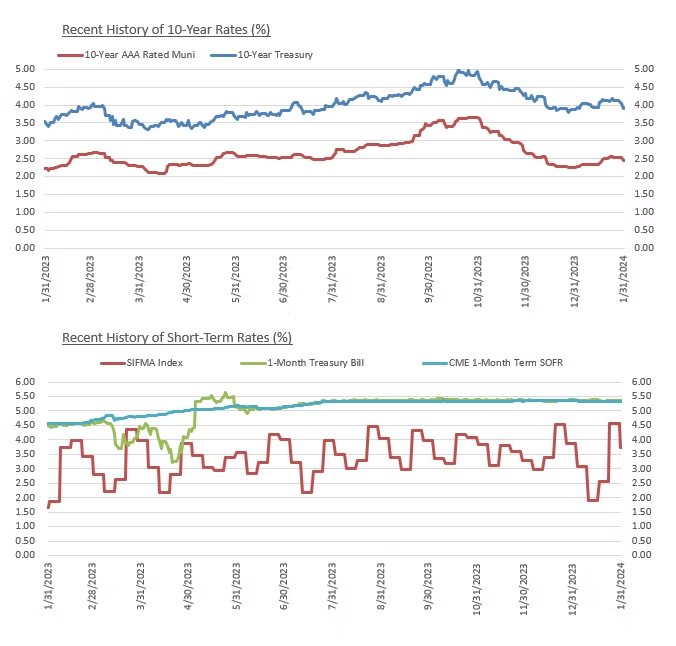

Similarly, the interest rate markets proved challenging in 2023. The Federal Reserve’s swift increases of the Fed Funds rate led to a significant inversion of the yield curve. Later in October of 2023, interest rates, as measured by the 10-year benchmark treasury rate, reached 15-year highs. Refinancings dissipated quickly and higher borrowing costs hindered capital improvement budgets. As we have articulated recently, the markets are not all doom and gloom, as opportunities exist to utilize the current interest rate environment to achieve positive arbitrage on refunding transactions and new money projects, when permissible. Fortunately, both tax-exempt and taxable rates are meaningfully off their highs from October as we hit the new year.

As we move into 2024, many challenges are already upon us, and likely more are to come. From an interest rate perspective, uncertainty and, possibly, significant volatility is anticipated. The Fed continues to combat inflation, though recent inflationary statistics suggest that inflation has moderated significantly since its highs of 2022, even if not yet to the Fed’s 2% target (with the Personal Consumption Expenditures (PCE) price index at 2.6% in December 2023). Despite the Fed’s significant rate increases that one would expect to cool the economic climate, robust labor and spending statistics perpetuated through the end of 2023, creating wonder about whether a forecasted recession would in fact materialize.

As a result, there remains significant uncertainty about whether the Fed’s December forecast for three rate cuts in 2024 will happen, even more so now given the Fed’s written statements on Jan. 31st that it needs “greater confidence that inflation is moving sustainably toward 2 percent” before considering any rate cuts. Economic indicators will factor into the direction of rates this year, but so, too, will the political landscape – including a forthcoming presidential election later this year. Therein lies the greatest concern about interest rate volatility, particularly as we approach Q4 2024.

Within the higher education sector, the challenges facing our nation’s colleges and universities are anticipated to persist particularly as the long-anticipated demographic “cliff” comes upon us. Not all higher education institutions will feel the squeeze from a declining high school graduate population, but many will. This challenge and others are well articulated within the sector outlooks published in December by each of the three major rating agencies that are summarized below.

Credit Rating Agencies: Higher Education 2024 Outlooks

Moody’s: Stable (revised from negative in 2023)

Moody’s believes revenue gains and moderating expense growth will improve operating performance, while financial reserves and gift revenue will support budget gaps in the short run.

S&P: Bifurcated / Mixed (consistent from 2023)

&P suggests the higher education sector is stable for institutions with strong demand and financial resources while the sector is negative for less selective institutions without financial flexibility.

Fitch: Deteriorating (the Credit Gap is widening in 2024 compared to 2023)

Fitch anticipates a deteriorating credit environment for the higher education sector due to labor pressures, elevated interest rates, and a very uneven enrollment recovery.

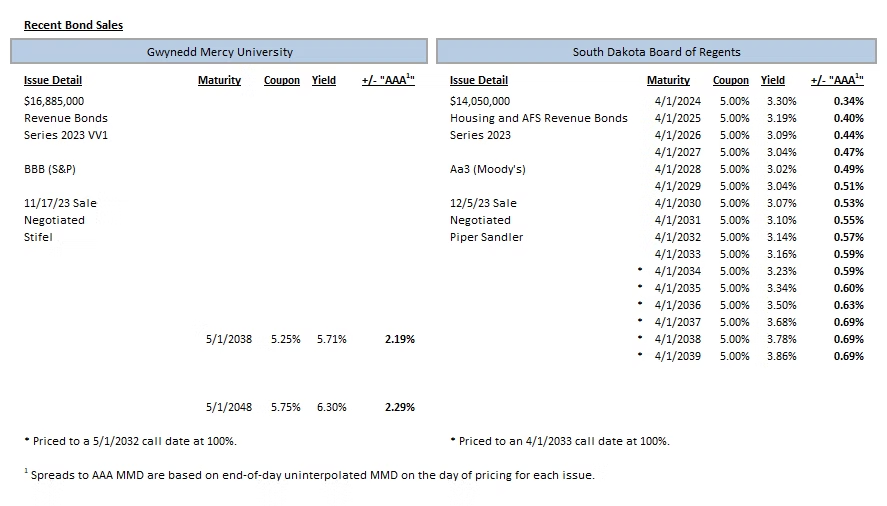

Comparable Issues Commentary

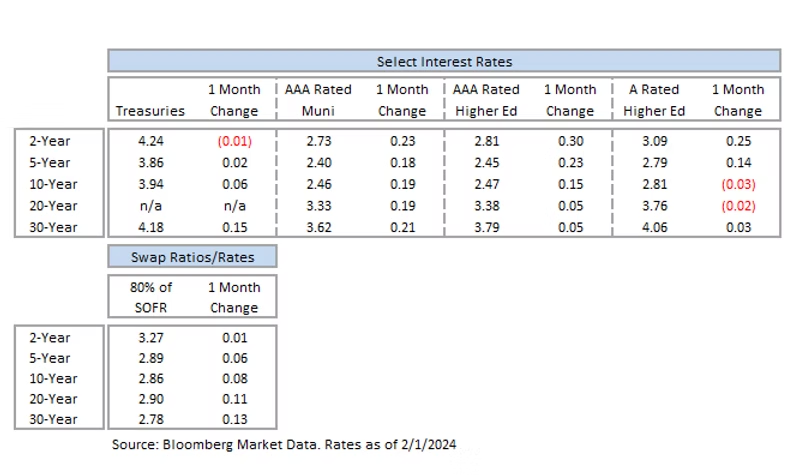

Interest Rates

Meet the Author:

Erik Kelly | [email protected] | 952-746-6055