Since we published our 2019 Municipal Market Year in Review market update in December, the financial markets have experienced historic turbulence with the onset of the COVID-19 pandemic. As a response to this turbulence, Blue Rose has begun publishing weekly “Special Editions” of The Shield to address key municipal market topics as they develop. This article takes a step back from these focused issues to address the general condition of the municipal market today – however, many of these past salient topics are summarized briefly as part of this article, with links included to some of our past pieces discussing them in greater detail.

Market Indices

- expanded quantitative easing programs

- continued trade tensions with China

- geopolitical tensions

- the upcoming presidential election

- potential future waves of COVID-19

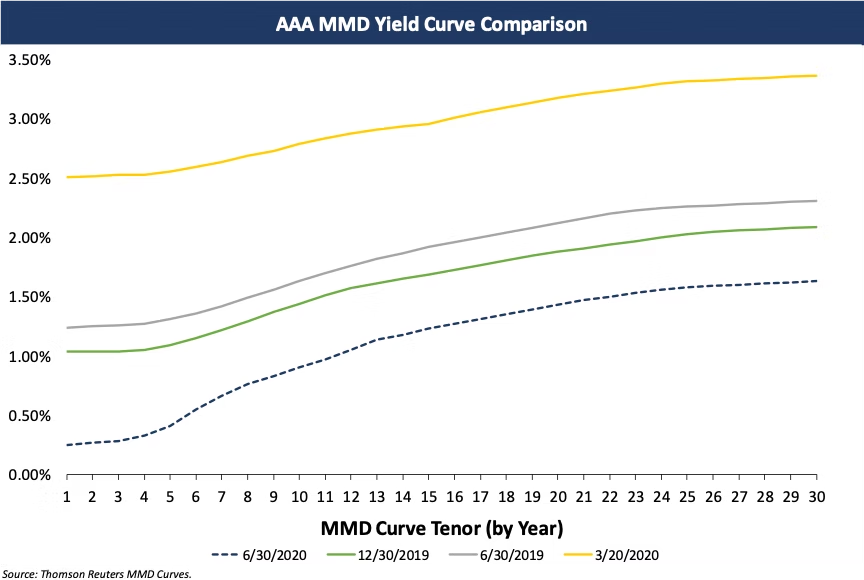

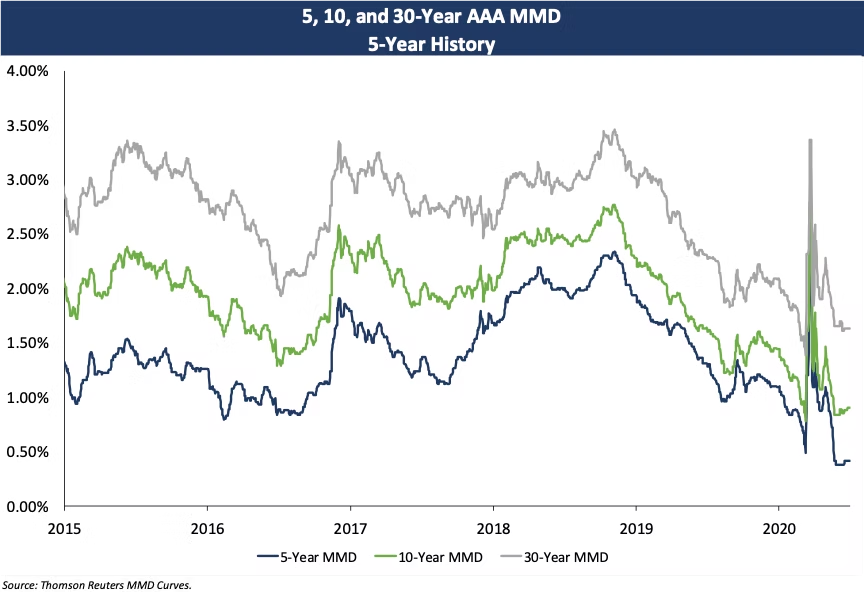

MMD:

Over the past year MMD has shifted downward by approximately 100 bps. However, in the immediate aftermath of the recent pandemic this index saw significant volatility. A look back at the March 20 MMD yield curve displays this well, with rates shifting upward by more than 200 bps above current levels. This significant momentary spike in March MMD rates is very evident when looking at a 5-year history of 5, 10, & 30-year AAA MMD (see the chart below), with those rates approaching recent historical highs, although the index has since begun to stabilize with the gradual rebound of the market in May and June.

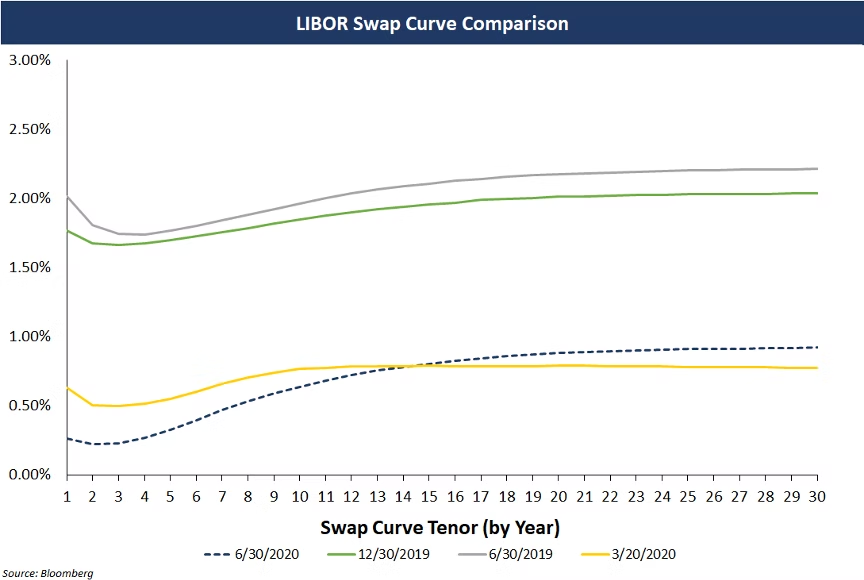

LIBOR:

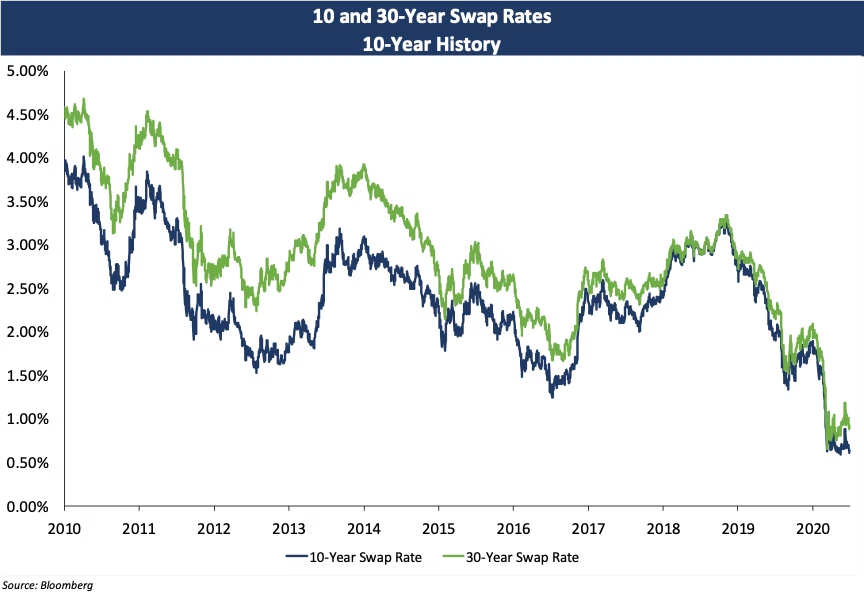

During the same period MMD was experiencing historic shocks, the LIBOR swap curve saw a much more modest adjustment. The LIBOR market remains near historic lows, albeit with some slight steepening resulting from the COVID-19 pandemic with an inflection point around the 15-year point on the curve.

Fed Funds:

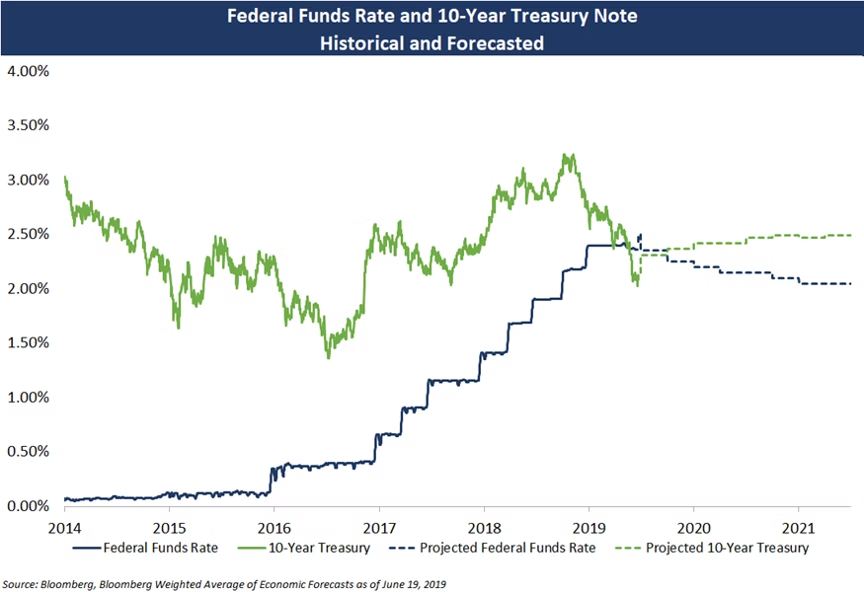

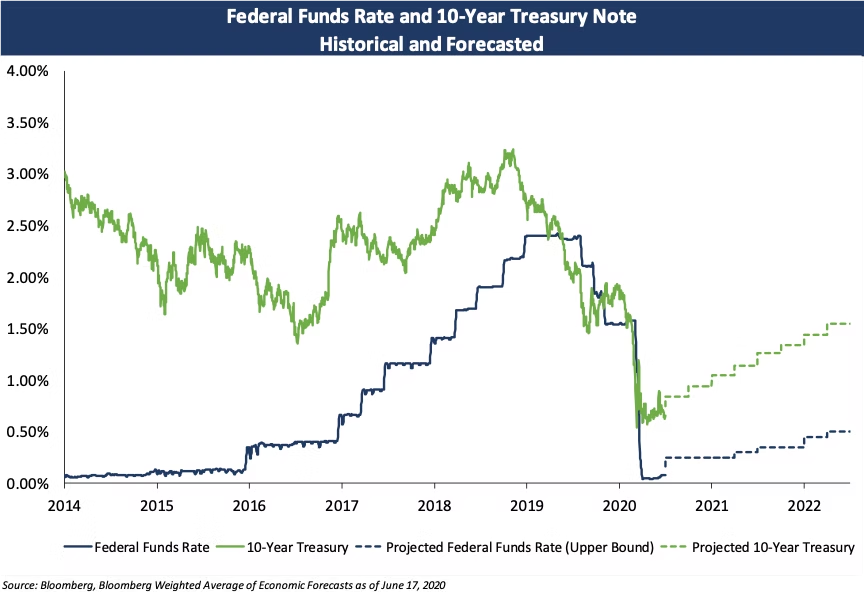

The Fed’s overnight target rate fell off a cliff as part of its response to the COVID-19 pandemic, with a target range of 0%-0.25% announced in early March. Comparing recent forecasts to those from last June, you can see this total reversal in the rate strategy and projections for its future growth/reduction. The Fed has indicated that it does not plan to target rate hikes in the foreseeable future, with the expectation being to maintain its current target range until 2022.

SIFMA/LIBOR:

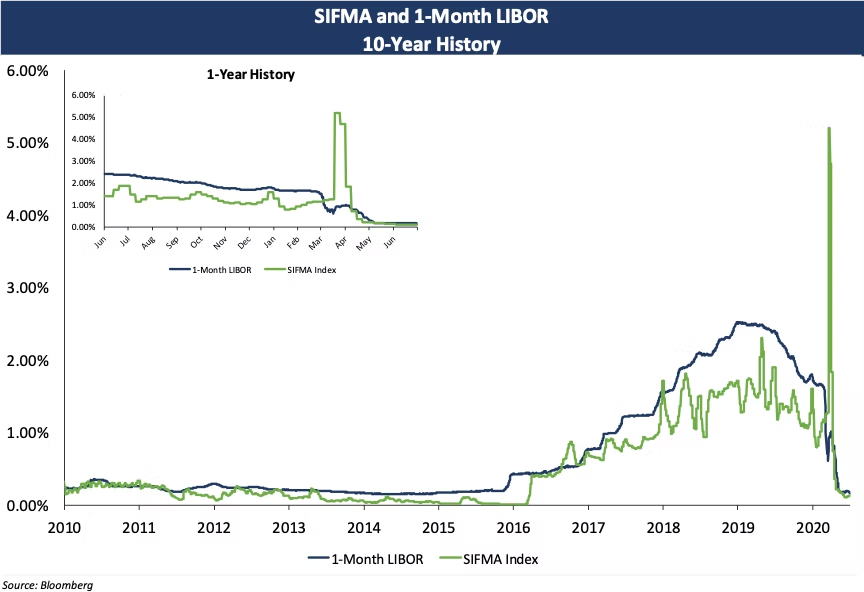

The SIFMA/LIBOR relationship has remained volatile, and briefly became dramatically dislocated at the beginning of the pandemic (with SIFMA spiking to above 5% while LIBOR remained low), though rates have normalized as a result of Fed action to stabilize the VRDB market since the initial March shock. Both indices have since fallen to very low levels (below 0.25%). Our May Basis Points Special Edition article touched on the basis risk between these two indices highlighted by the severe dislocation between them in March, as well as potential actions that issuers could take to mitigate this risk in the current market.

Paycheck Protection Program

Government stimulus played a major role over the last few months with the economy struggling to respond to a shutdown of public spaces. The CARES ACT was the primary source of stimulus for small business and non-profit institutions over this period – see our Special Edition of The Shield from April, which touched on the PPP portion of this program as it kicked off, for additional information. Since then, there have been several significant clarifications/changes to the PPP including but not limited to:

- 24-week disbursement period

- 60% of funds must be used for payroll

- have until December 31, 2020 to restore salary/hourly wage/FTE reductions

- extension of the deferral of loan payments

- more flexibility in the maturity of the loan

- likely $2MM review exemption.

The PPP loan application window closed on June 30, 2020 with $130 billion remaining unspent. However, soon after this window closed the Senate and House voted to approve a 5-week extension, meaning borrowers now have until to August 8th to apply.

Credit Rating Agency Actions

LIBOR Transition

About the Author

Mr. Lippold holds a bachelor’s degree in financial management from the University of St. Thomas and is a member of their chapter of the Delta Epsilon Sigma honors society. Mr. Lippold passed the MSRB Series 50 Examination to become a qualified municipal advisor representative and also is currently pursuing his Chartered Alternative Investment Analyst (CAIA) designation, for which he has passed the level 1 exam.

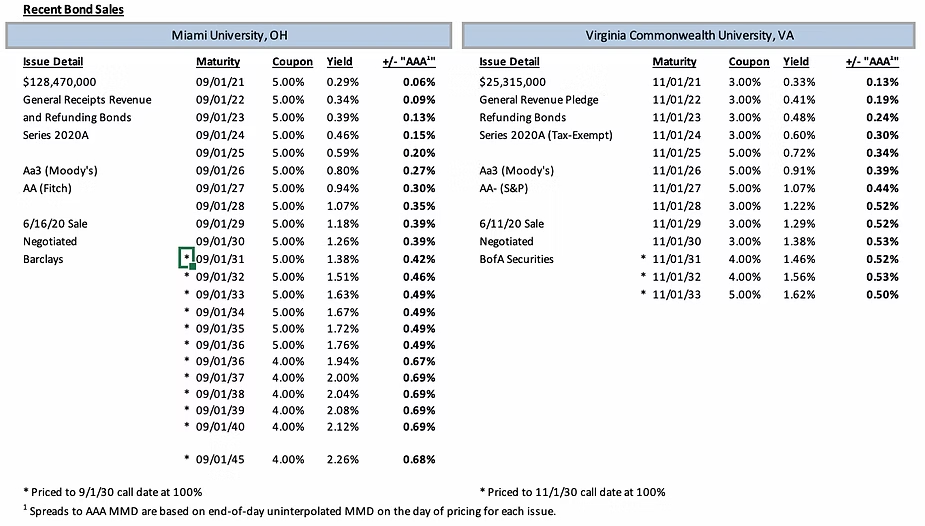

Comparable Issues Commentary

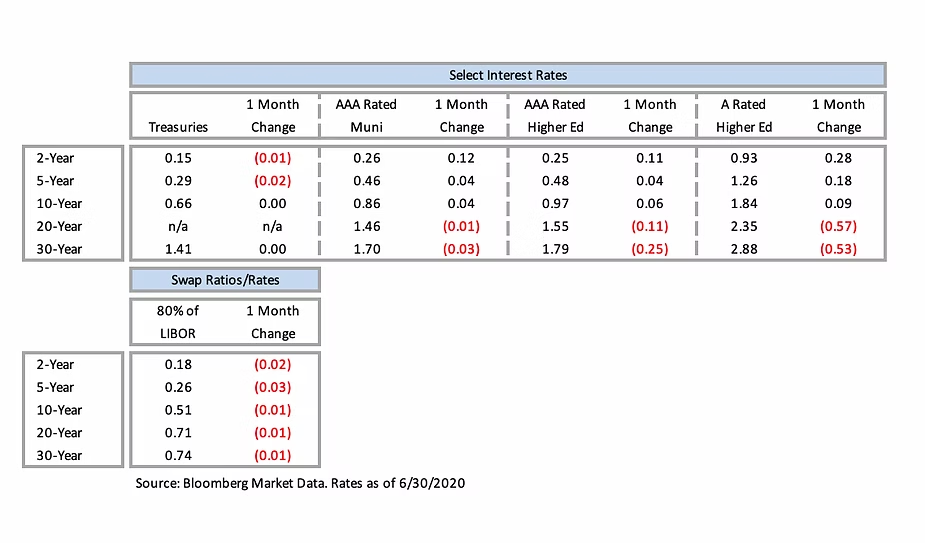

Interest Rates